how to be smart with a credit card How To Use a Credit Card. Using a credit card is as simple as you make it. A few basic rules you, as a cardholder, can follow for the extent of your credit card’s life will keep it. $1.89Yes it's normal. I use a couple of old credit cards to trigger events around my home. 1. Don .

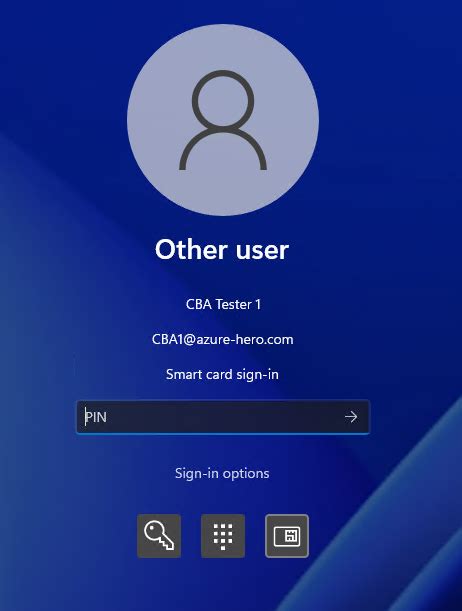

0 · smartcard login

1 · smart credit log in

2 · smart credit cards to open

3 · smart card terms and conditions

4 · smart card identity card

5 · smart card identification

6 · exxon smart card credit log

7 · credit cards with no annual fee and no interest

Posted on Nov 1, 2021 12:10 PM. On your iPhone, open the Shortcuts app. Tap on the Automation tab at the bottom of your screen. Tap on Create Personal Automation. Scroll down and select NFC. Tap on Scan. Put .

Stay on top of your monthly payments and avoid costly fees and interest . How To Use a Credit Card. Using a credit card is as simple as you make it. A few basic rules you, as a cardholder, can follow for the extent of your credit card’s life will keep it. Using a credit card to pay for day-to-day purchases is a smart idea. Paying with credit is convenient, it's generally safer than using cash or debit, and it can be highly rewarding. Plus, if.

Stay on top of your monthly payments and avoid costly fees and interest charges with these smart credit card strategies. 1. Use a Credit Card to Build Credit. When you learn how to use your credit card the right way, you'll see your credit standing improve. To move things along more quickly, use less than 10%.How to be a smart credit card user. Here are 12 tips to help all of us use credit cards more responsibly. There’s a reason credit cards are a big part of modern life: they’re easy to use, they add extra purchasing power, and they offer the opportunity to build a healthy credit score.

1. Pick a card that works for you. As long as you take the time to choose a credit card wisely, using a credit card can be a smart way to shop. There are several types of credit. On the surface, using a credit card is easy; you just swipe, tap, or insert to pay. It's important to understand how card payments and interest work to avoid large interest fees. The key to.

Follow these steps to use your credit card wisely as a tool for improving your credit and maximizing rewards. Using your credit card wisely can lower the amount of interest you pay and improve your credit. Here are tips that could help you get out of credit card debt. But what’s the best way to use a credit card to your advantage? We’ll explore four key strategies, including building credit, earning rewards, paying down debt and financing a purchase. We’ll also share some tips for getting the most out of your credit card without racking up unnecessary debt or negatively impacting your credit.

smartcard login

How To Use a Credit Card. Using a credit card is as simple as you make it. A few basic rules you, as a cardholder, can follow for the extent of your credit card’s life will keep it. Using a credit card to pay for day-to-day purchases is a smart idea. Paying with credit is convenient, it's generally safer than using cash or debit, and it can be highly rewarding. Plus, if. Stay on top of your monthly payments and avoid costly fees and interest charges with these smart credit card strategies. 1. Use a Credit Card to Build Credit. When you learn how to use your credit card the right way, you'll see your credit standing improve. To move things along more quickly, use less than 10%.

How to be a smart credit card user. Here are 12 tips to help all of us use credit cards more responsibly. There’s a reason credit cards are a big part of modern life: they’re easy to use, they add extra purchasing power, and they offer the opportunity to build a healthy credit score. 1. Pick a card that works for you. As long as you take the time to choose a credit card wisely, using a credit card can be a smart way to shop. There are several types of credit.

On the surface, using a credit card is easy; you just swipe, tap, or insert to pay. It's important to understand how card payments and interest work to avoid large interest fees. The key to.

Follow these steps to use your credit card wisely as a tool for improving your credit and maximizing rewards. Using your credit card wisely can lower the amount of interest you pay and improve your credit. Here are tips that could help you get out of credit card debt.

smart credit log in

smart card pairing big sur

smart card one

View the Box Score for the NFL football game between the Green Bay Packers and the San Francisco 49ers on January 3, 1999. . 1998 NFC Wild Card Game Green Bay .1998–99 NFL playoffs; Dates: January 2–31, 1999: Season: 1998: Teams: 12: . the third-seeded division winner hosted the sixth seed wild card, and the fourth seed hosted the fifth. The 1 and 2 seeds from each conference received a first . This was the first NFC Championship Game to go to overtime (since, there . See more

how to be smart with a credit card|credit cards with no annual fee and no interest