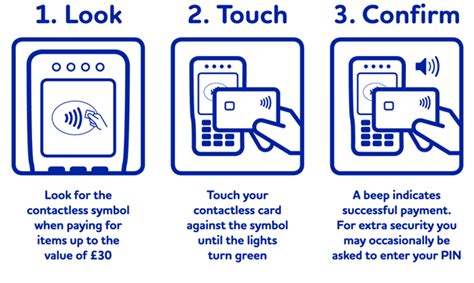

using a contactless card Tapping to pay uses short-range wireless technology to make secure payments between a contactless card or payment-enabled mobile/wearable device and a contactless-enabled checkout terminal. When you tap your card or device near the Contactless Symbol, your . y : Clinched Wild Card. z : Clinched Division. * : Clinched Division and Homefield Advantage. See the latest NFL Standings by Division, Conference and League. Find current or past season NFL.

0 · how to use contactless payment

1 · how does contactless payment work

2 · how does contactless card work

3 · contactless symbol atm

4 · contactless debit card security

5 · contactless debit card means

6 · contactless credit card symbol

7 · american express contactless card

With Blue Social, your guests will be able to easily connect and exchange contact .

Tapping to pay uses short-range wireless technology to make secure payments between a contactless card or payment-enabled mobile/wearable device and a contactless-enabled checkout terminal. When you tap your card or device near the Contactless Symbol, your .

Cardholders can pay with a contactless card by holding the card flat and tapping it at a contactless-enabled checkout terminal. The payment is processed using the same dynamic security technology as with card payments, and the transaction time takes seconds.Contactless payments are transactions made by tapping either a contactless card or payment-enabled mobile or wearable device over a contactless-enabled payment terminal. Cards, phones, watches and other devices use the same contactless technology.Contactless Payments: A card-present acceptance channel that uses a specialized point of sale (POS) device that can communicate with a contactless-enabled card to facilitate purchase transactions.Tap to Phone also enables customers to make safe, contactless payments with a tap of their contactless card, phone, or wearable device to the seller’s smartphone using the same Tap to Pay technology that consumers know and trust.

What is contactless? Contactless is a secure, digital technology based on EMV, the global standard for smart cards. It can be deployed on payment cards, mobile phones and many other devices such as wearables. And its aim is to make payments quicker and more convenient – while keeping them secure.With Tap to Phone (TTP), merchants anywhere can securely accept contactless payments on the near-field enabled Android and Apple smartphones they already own. Simply by downloading an app.

Customers can soon simply tap their Chase Visa contactless cards or mobile device at the turnstile to ride the subway or bus. Whether a local or visitor to New York City, the rider experience is the same – fast, easy and secure.The most common practice in the U.S. is to add a tip or gratuity after the authorization has occurred. This practice can continue since EMV supports the same process. There are two basic models for authorizing tips and gratuities added to a .

Contactless payments are also one of the most secure ways to pay, using the same dynamic security as contact EMV® Chip cards. In this video, Visa’s North America Risk Officer Margaret Reid explains the security behind contactless payments.

Tapping to pay uses short-range wireless technology to make secure payments between a contactless card or payment-enabled mobile/wearable device and a contactless-enabled checkout terminal. When you tap your card or device near the Contactless Symbol, your .Cardholders can pay with a contactless card by holding the card flat and tapping it at a contactless-enabled checkout terminal. The payment is processed using the same dynamic security technology as with card payments, and the transaction time takes seconds.Contactless payments are transactions made by tapping either a contactless card or payment-enabled mobile or wearable device over a contactless-enabled payment terminal. Cards, phones, watches and other devices use the same contactless technology.

Contactless Payments: A card-present acceptance channel that uses a specialized point of sale (POS) device that can communicate with a contactless-enabled card to facilitate purchase transactions.Tap to Phone also enables customers to make safe, contactless payments with a tap of their contactless card, phone, or wearable device to the seller’s smartphone using the same Tap to Pay technology that consumers know and trust.What is contactless? Contactless is a secure, digital technology based on EMV, the global standard for smart cards. It can be deployed on payment cards, mobile phones and many other devices such as wearables. And its aim is to make payments quicker and more convenient – while keeping them secure.With Tap to Phone (TTP), merchants anywhere can securely accept contactless payments on the near-field enabled Android and Apple smartphones they already own. Simply by downloading an app.

Customers can soon simply tap their Chase Visa contactless cards or mobile device at the turnstile to ride the subway or bus. Whether a local or visitor to New York City, the rider experience is the same – fast, easy and secure.The most common practice in the U.S. is to add a tip or gratuity after the authorization has occurred. This practice can continue since EMV supports the same process. There are two basic models for authorizing tips and gratuities added to a .

how to use contactless payment

rfid reader with phone

Blinq is the top-rated QR code business card app on the App Store and the Play Store, with a 4.9/5 rating. We’re also the fastest growing app. Blinq is the quickest and easiest way to share your contact details with people. You can share your .

using a contactless card|how does contactless card work