emv vs rfid chip Contactless covers everything from NFC to QR codes. We look at the various technologies that . The usual "it depends". Check the datasheet of the cards you want to work .

0 · what does emv chip mean

1 · rfid vs emv

2 · nfc vs rfid

3 · how does emv chip card work

4 · emv vs nfc credit card

5 · emv vs nfc

6 · emv chip and signature

7 · emv chip and pin card

About Credit Card Reader NFC (EMV) 5.5.6. This app was designed to allow .

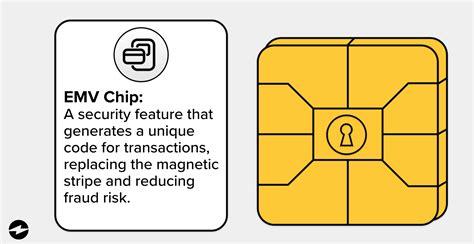

Contactless covers everything from NFC to QR codes. We look at the various technologies that . EMV chip cards are embedded with a special microprocessor chip that stores and protects cardholder data. Every time you make a purchase, this chip creates a unique transaction code that cannot be used again. This makes EMV chip cards much more secure than traditional magnetic stripe cards.Contactless covers everything from NFC to QR codes. We look at the various technologies that underpin your contactless transactions and the difference between them all. Radio frequency identification (RFID) is a contactless and wireless way to transfer data through radio waves. Here’s a breakdown between EMV vs. NFC payments—and why it makes sense to start accepting both at your business. And if you want an even deeper dive into EMV chip cards and NFC payments check out our comprehensive guides (linked above).

Inside of a credit card, there is an EMV chip with 8 contact pins that facilitates EMV transactions, which are safer than “swiped” payments. If your credit card is contactless-enabled, there is also a tiny RFID chip and a long, winding antenna inside the card, which allow for contactless payments via RFID technology. RFID payments work by transmitting information between a credit card — specifically, the computer chip and antenna embedded within it — and a contactless reader. That information takes the form.

While RFID technology can be used for contactless payment processing, it is not the same as EMV (Europay, Mastercard, and Visa) technology. EMV technology refers specifically to chip-based credit and debit cards that process payments using .

Meanwhile, the EMV technology ensures that information is tokenized and remains secure during transmission. In other words, EMV keeps your information safe and NFC allows for contactless payment. Both come into play when you use a chip-and-pin card, regardless of whether you choose to dip or tap. EMV stands for Europay, Mastercard and Visa. It’s a technology and payment method designed to limit fraud by using embedded computer chips on credit and debit cards. Businesses that do not use . Standard EMV payments use the chip embedded on a credit or debit card to gather the card details and process payments. When it comes to NFC payments, the card or digital wallet is placed near the payment terminal and RFID is used to .EMV is generally considered more secure than RFID because it uses a chip-and-PIN system that encrypts data during transactions and creates unique identifiers for each cardholder within the system.

EMV chip cards are embedded with a special microprocessor chip that stores and protects cardholder data. Every time you make a purchase, this chip creates a unique transaction code that cannot be used again. This makes EMV chip cards much more secure than traditional magnetic stripe cards.Contactless covers everything from NFC to QR codes. We look at the various technologies that underpin your contactless transactions and the difference between them all. Radio frequency identification (RFID) is a contactless and wireless way to transfer data through radio waves. Here’s a breakdown between EMV vs. NFC payments—and why it makes sense to start accepting both at your business. And if you want an even deeper dive into EMV chip cards and NFC payments check out our comprehensive guides (linked above). Inside of a credit card, there is an EMV chip with 8 contact pins that facilitates EMV transactions, which are safer than “swiped” payments. If your credit card is contactless-enabled, there is also a tiny RFID chip and a long, winding antenna inside the card, which allow for contactless payments via RFID technology.

RFID payments work by transmitting information between a credit card — specifically, the computer chip and antenna embedded within it — and a contactless reader. That information takes the form.

While RFID technology can be used for contactless payment processing, it is not the same as EMV (Europay, Mastercard, and Visa) technology. EMV technology refers specifically to chip-based credit and debit cards that process payments using . Meanwhile, the EMV technology ensures that information is tokenized and remains secure during transmission. In other words, EMV keeps your information safe and NFC allows for contactless payment. Both come into play when you use a chip-and-pin card, regardless of whether you choose to dip or tap. EMV stands for Europay, Mastercard and Visa. It’s a technology and payment method designed to limit fraud by using embedded computer chips on credit and debit cards. Businesses that do not use . Standard EMV payments use the chip embedded on a credit or debit card to gather the card details and process payments. When it comes to NFC payments, the card or digital wallet is placed near the payment terminal and RFID is used to .

gt08 fashionable sim card nfc smart watch manual

what does emv chip mean

rfid vs emv

Note that it is not stated as "Prepaid SIM" which refer to the SIM card as prepaid. Prepaid MasterCard (NFC) is similar to EzLink Card (NFC) with prepaid value stored in the .

emv vs rfid chip|emv chip and signature